Smaller firms tapping bond markets

Source: AsiaOne, By MOK FEI FEI

More are seeing bonds as faster more flexible way to raise capital

SMALLER companies and other institutions are increasingly seeing bonds as a faster and more flexible way to raise capital, as two firms demonstrated in the first week of this month.

This mid-cap Vibrant Group and Swiber Holdings both issued bonds to resounding success.

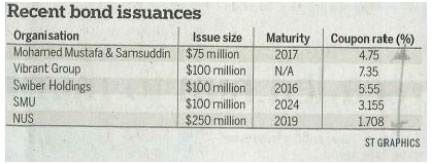

Even unlisted entities, such as Singapore Management University (SMU), the National University of Singapore (NUS) and Mohamed Mustafa & Samsuddin, the owner of retailer Mustafa Centre, have sold bonds in the first quarter of this year.

Vibrant, formerly known as Freight Link Express, issued its first perpetual bonds- bond-like instruments with no maturity or voting rights but with higher coupon rates- while Swiber delved into the bond market with a $100 million issue.

The order book for the Vibrant perpetual was over $300 while Swiber's came to more than $500 million, far exceeding the amounts targets by the firms.

DBS was the sole book runner for the two bond issuances.

Mr Clifford Lee, its head of fixed income, noted that bonds provide an alternative source of debt financing. "It's all a matter of diversification for the companies and issuers," he said.

"They are realising that instead of just bank loans, they can access funds of a tenor or pricing, that's more suited to their needs."

The use of bonds is also gaining traction elsewhere. Retailer Mustafa raised $75 million, while NUS raised $250 million in February after last tapping the bond market in January last year.

SMU also launched its first-ever tranche last month with $100 million in bonds. The funds are earmarked for "building additional research and teaching facilities to meet a growing student population", a spokesman said. NUS and SMU said the bonds were taken up by financial institutions and other sophisticated investors.

Greater clarity above the United States Federal Reserve's monetary policy- which impacts bond pricing- has also helped to increase market activity, after uncertainty over the Fed's pullback of its monetary stimulus caused interest rate volatility that all but shut down the bond market here.

Mr Lee pointed out that investors no long expect a sudden spike in interest rates and have priced in their expectations accordingly. Companies also recognises that the era of low interest rates will be over and can better price their bonds.

After the Fed's announcement last December that it would reduce its bond purchases by US$10 billion (S$12 billion) a month, some smaller companies waded back into the debt market to lock in the low rates.

Mr Luc Froehlich, senior director for Asian fixed income at Manulife Asset Management Singapore, noted that both supply and demand for bonds have risen.

"A lot of these SMEs (small and medium-sized enterprises) are taking to the markets. Besides taking advantage of the historically low yields for the issuers, there's also a demand for (bonds); we understand private banking clients are interested in the high-yield bonds.

The bonds are being sold to sophisticated investors, so at least $250,000 is needed. Demand is still strong, noted Mr Froehlich.

"Some of the investors see that the equities markets are maybe getting a little more expensive, so they don't want to be fully exposed to these markets," he said.

"GROWING DEMAND

A lot of these SMEs are taking to the markets. Besides taking advantage of the historically low yields for the issuers, there's also a demand for (bonds); we understand private banking clients are interested in the high-yield bonds.

- Mr Luc Froehlich. Senior director for Asian fixed income

at Manulife Asset Management Singapore"

Several mid-cap firms, or those with a market capitalisation below S$1 billion, tapped the bond market in the first quarter of this year. Among the 38 issuances of Singapore dollar bonds, seven were offered by mid-caps, including logistics and commodities trading firm CWT, offshore marine service provider, Vallianz and manufacturer Amtek.

A finance chief at a mid-cap firm, who declined to be named, said the low interest rates before the expected hike is a push factor for selling the bonds. He added that there are other plus factors as well. Firms do not have to put up collateral when issuing bonds, for example. This means the amount they raise are not limited as they are at a bank, which would demand a collateral.

"Bonds can be issued in a few weeks, while banks can sometimes take a few months to approve a loan as they conduct their due diligence," he added.